The Importance of Knowledge Management in Banking

As banks face new and evolving challenges, they can gain a competitive advantage with knowledge management. These challenges range from digitization and virtualization of the workplace to complying with complex government regulations and addressing the growing security concerns. In responding to these hurdles, financial leaders have recognized the value of knowledge management in the banking sector.

Knowledge management in banking allows financial services organizations to more efficiently store and organize knowledge, which enables bank managers and employees to collaborate and stay aligned on short- and long-term initiatives. By integrating knowledge management, banking firms can better understand their employees, customers, and even their own products and services.

Here’s a closer look at why knowledge management is essential and how banks use it to their advantage.

Why Knowledge Management in the Banking Sector Is Important

The importance of knowledge management in the banking sector cannot be overstated. It is essential for maintaining compliance with increasingly complex and demanding regulatory requirements. By having a robust knowledge management system in place, banks can ensure that they meet legal obligations while minimizing risks associated with non-compliance.

Additionally, effective knowledge management supports innovation by creating an environment that fosters the development and efficient implementation of new ideas. Banks can leverage their collective expertise to develop new products and services, enter new markets, and improve existing offerings.

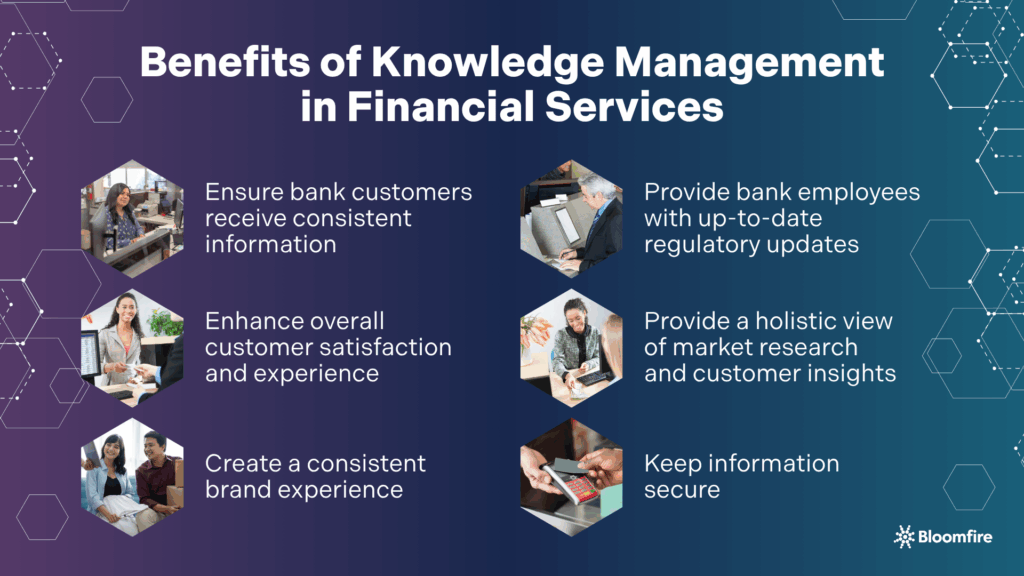

How the Financial Industry Benefits from Knowledge Management

Fortunately, banks can combat these challenges with effective knowledge management systems. By implementing a comprehensive knowledge management framework, bank managers can improve customer relationships, streamline document management, and ultimately gain a competitive advantage. Here’s a look at a few specific ways knowledge management can benefit the banking sector.

1. Ensure bank customers receive consistent information at any branch

Banking customers should receive consistent information, regardless of which branch they visit or the individual employee they interact with. A centralized knowledge management system ensures that all employees have access to the same information, so they can provide standardized answers to customers, no matter where they’re located.

In fact, 23% of respondents in Bloomfire’s Value of Enterprise Intelligence Report believe they would save at least an hour when creating something new if they could just find the right document. Streamlining access to crucial information enables banks to empower their employees to provide accurate, consistent answers while also enhancing productivity.

2. Enhance overall customer satisfaction and the customer experience

When banking customers call or visit branches with questions, they expect timely and accurate answers. Equipped with a knowledge management system, employees can quickly search for the information they need to provide comprehensive solutions to client issues, leading to a better overall customer experience.

Such an outcome translates to faster resolution times and fewer frustrating transfers, significantly boosting customer satisfaction. For instance, our report shows that companies in the regional banking sector noted a 36% improvement in first contact resolution (FCR) and a 32% reduction in average handle time (AHT) among customer support teams. All of these data are associated with fast and efficient information retrieval.

3. Create a consistent brand experience, both digitally and in person

Banking customers increasingly expect digital service options (such as mobile banking and AI-powered chatbots) as well as in-person interactions. With a comprehensive knowledge management system, you can ensure that you present a unified experience, no matter how a customer interacts with your institution.

The consistency across all channels, influenced by fluid knowledge sharing, builds trust and reinforces your brand’s reliability. This seamless integration of information contributes to modern customer expectations and fosters lasting loyalty.

4. Provide all bank employees with up-to-date regulatory updates

New laws and regulations can majorly affect banking institutions’ policies, and those updates can happen rapidly and unexpectedly. With a knowledge management system, you can ensure that all employees receive updates about regulatory changes and understand how they impact the bank and its customers.

A central repository of information helps your institution maintain compliance and empowers your team to guide customers through evolving financial landscapes accurately. In a case study by FinregE, a large global bank operating in over 100 countries implemented a knowledge management strategy that includes the use of a Regulatory Intelligence Gateway (RIG). Their goal is to review approximately 1,500 regulatory publications per week, spanning thousands of pages, with a team of five full-time employees.

The project streamlined their regulatory compliance processes, improved operational efficiency, and minimized compliance risks. It demonstrated how a centralized, intelligent knowledge management system enables banks to adapt quickly and accurately to evolving financial regulations.

5. Provide a holistic view of market research and customer insights

Customer insights help leaders across the banking organization make informed decisions about product offerings, messaging, and how best to deliver on customer needs and expectations. But all too often, insights that could benefit the entire organization become siloed within departments or lines of business.

By using a knowledge management platform to centralize all research (and make everything searchable), you give all internal stakeholders access to the insights they need to make informed decisions.

6. Keep information secure

Bank customers want to be confident that their information is secure and protected from cyber threats. A knowledge management system with robust security features will keep all customer information safe. The enhancement of security in banking is evident in the way financial institutions manage and disseminate cybersecurity protocols and best practices.

Many data breaches in banking are attributed to human error, often stemming from a lack of employee awareness or insufficient adherence to security policies. For instance, the 2021 Robinhood data breach occurred because malicious actors used social engineering to trick a customer support employee into giving them access to certain systems.

That incident affected around 7 million users. But it also highlights the critical need for thorough and continuously updated employee training that addresses evolving cybercriminal strategies.

What Kinds of Knowledge Management Systems Are Available For Banks?

Once you understand the importance of knowledge management in banking, the next step is evaluating and selecting a system for your institution. Banks can choose from a wide range of KM systems and strategies, including:

1. Digital asset management system

This type of system houses company documents in one central location. Similar to a company intranet or SharePoint, a digital asset management system can be used company-wide or by individual departments or branches. It simplifies document retrieval and ensures everyone works with the most current versions.

2. Decision tree

With decision tree software, employees can navigate common customer questions to reach a resolution. During a customer interaction, the bank employee answers a series of multiple-choice questions based on the customer’s needs and responses. Eventually, the flowchart-like system leads the employee to a resolution.

3. AI chatbots

Chatbots work in a similar way to decision tree software, but are designed to be customer-facing. Through AI-powered interactions, chatbots can lead customers to the information they’re looking for. These intelligent assistants provide instant support, resolving queries around the clock and significantly enhancing the customer’s digital experience.

4. Knowledge management platform

A centralized knowledge management platform, sometimes referred to as a knowledge base, is designed to democratize knowledge across departments or an entire organization. More sophisticated than a digital asset management system, a knowledge management platform can contain powerful search functions, the ability to customize how information is structured, permissioning capabilities, and robust security features.

5. Collaboration platform

These platforms enable real-time sharing of insights and expertise among employees, accelerating problem-solving and decision-making. They also serve as a vital repository for informal knowledge, allowing teams to learn from each other’s experiences and best practices. Enhanced internal collaboration directly supports improved customer service, regulatory compliance, and overall operational agility within the complex banking environment.

6. Enterprise Social Networks (ESN)

Unlike traditional, static intranets, ESNs facilitate informal communication and collaboration, allowing employees to quickly connect with experts and access tacit knowledge. This ability to share insights and best practices across departments helps break down silos within large banking organizations.

The array of knowledge management systems available offers banks powerful tools to streamline operations, enhance compliance, and elevate the customer experience. From internal knowledge bases and robust document management to AI-driven expert systems and collaborative platforms, each type addresses distinct needs within the complex financial landscape.

For banks seeking a comprehensive solution that can integrate many of these functionalities into a cohesive ecosystem, Bloomfire serves as a one-stop shop for diverse KMS requirements. Its ability to centralize various knowledge assets, combined with features such as AI-powered search and robust security, positions it as a strategic investment for financial institutions seeking superior information governance and operational excellence.

KM for Modern Banking

Optimize banking with powerful KM. Boost compliance, CX, & efficiency.

Learn More

Key Components of a Knowledge Management System in Banks

Establishing a robust framework for organizational intelligence is paramount for modern financial institutions as it ensures precision and timely access to information. That said, when choosing a KMS, make sure you’re considering the key KM features and tools for your business.

A comprehensive knowledge management system in banks comprises several key components that ensure the efficient handling of information. These components include:

- Data collection and storage: A robust system for gathering and storing data from various sources, such as customer interactions, market research, and internal reports. This data forms the foundation upon which knowledge is built.

- Information sharing platforms: Tools and platforms that facilitate the sharing of knowledge across departments and with external stakeholders. This includes intranets, collaboration tools, and secure portals for exchanging information.

- Knowledge repositories: Centralized databases where structured and unstructured data are stored for easy access and retrieval. These repositories support decision-making by providing comprehensive insights into the bank’s operations and market trends.

- Analytics and reporting: Advanced analytics tools that process and interpret data to generate actionable insights. These tools help banks identify patterns, predict outcomes, and make informed decisions.

- Training and development: Programs designed to equip employees with the skills and knowledge needed to utilize the knowledge management system effectively. Continuous training ensures that staff can fully utilize the system’s benefits.

A well-formed knowledge management strategy ensures that every piece of information contributes to the institution’s overall success. Integrating these components enables banks to create a seamless flow of information that supports strategic objectives and enhances operational efficiency.

Common Knowledge Management Challenges In the Banking Sector

The banking sector is changing, and that evolution has only accelerated in the wake of the global pandemic. Banks must now contend with increased competition, new business models, and rising consumer expectations. Failing to take a strategic approach to knowledge management can lead to significant business challenges, including:

- Cultural Resistance: Employees may resist change, particularly if they perceive knowledge management in banks as burdensome or unnecessary. To overcome this challenge, banks must foster a culture that values and rewards knowledge sharing.

- Lack of customer-facing information: A consumer survey by Nuance Enterprise revealed that 67% of respondents prefer a self-service option over speaking with a customer service representative. Banks without a self-service knowledge management option may strain customer relationships.

- Data Silos: Information may be scattered across different departments and systems, making it difficult to create a comprehensive knowledge management system. Banks can address information silos by implementing integrated platforms that consolidate data from multiple sources.

- Security breaches: In the first half of 2021, there were more than 1,700 publicly reported data breaches. Security risks are at the top of many customers’ minds, especially given the sensitive nature of bank account information. A centralized knowledge management system can give bank employees a shared view of security protocols and best practices to help mitigate the risk of a breach. However, it’s also essential that the knowledge management technology itself has strict security measures in place.

- Delays in information availability: Banking is highly regulated and influenced by government policies. If employees aren’t aware of regulatory changes, they may distribute incorrect information and put the bank at risk, especially in today’s uncertain and sometimes volatile environment.

From capturing crucial tacit knowledge before experienced employees retire to maintaining information consistency across myriad channels and addressing regulatory changes with agility, these hurdles demand strategic solutions. Conquering these challenges is not merely about efficiency; it ensures sustained compliance, superior customer experiences, and long-term competitive advantage in a highly dynamic sector.

Frequently Asked Questions

How do banks manage their knowledge assets?

Banks strategically manage their knowledge assets by leveraging internal databases and sophisticated document management systems to centralize financial data, customer information, and regulatory guidelines. They nurture a culture of continuous learning and information sharing through training programs and collaborative platforms. As a result, employees have access to the latest insights and best practices.

What is knowledge management in the banking industry?

Knowledge management in the banking sector is the strategic process of capturing, organizing, sharing, and utilizing the vast amounts of information and expertise within a financial institution. It aims to enhance decision-making, improve customer service, foster innovation, and ensure compliance by making relevant knowledge readily accessible to employees.

How can banks overcome challenges in implementing knowledge management systems?

Banks can address challenges by fostering a culture of knowledge sharing, implementing integrated platforms, prioritizing strategic initiatives, and ensuring robust security and compliance measures. They should adopt a phased implementation approach, starting with pilot programs to refine the system and address user feedback before a full-scale rollout.

Improve Banking Operations With Centralized Knowledge

In the current environment, knowledge management in the banking sector isn’t a nice-to-have—it’s a necessity. Banks that want to rise above the competition and meet customers’ evolving needs must consider how to integrate knowledge management systems and strategies within their institutions effectively. With the right solution in place, financial services organizations can meet the needs of their clients now and well into the future.

Knowledge Management for Banking

Discover how Bloomfire’s KM solutions improve efficiency in banking.

Learn More

10 Best Knowledge Management Practices in 2026

Different Types of Knowledge: Implicit, Tacit, and Explicit

Striking the Right Balance Between AI and Human Customer Service

Estimate the Value of Your Knowledge Assets

Use this calculator to see how enterprise intelligence can impact your bottom line. Choose areas of focus, and see tailored calculations that will give you a tangible ROI.

Take a self guided Tour

See Bloomfire in action across several potential configurations. Imagine the potential of your team when they stop searching and start finding critical knowledge.